Smokeball Bill makes it easy to protect funds in Trust Retainer Accounts. Smokeball Bill offers the ability for firms to set aside and protect funds that have been earmarked for a specific purpose, ensuring those funds do not get used accidentally.

This article walks through how to protect funds, where the protected funds can be found and managed, as well as how to unprotect the funds once your firm is ready to use them.

Protecting Trust Funds

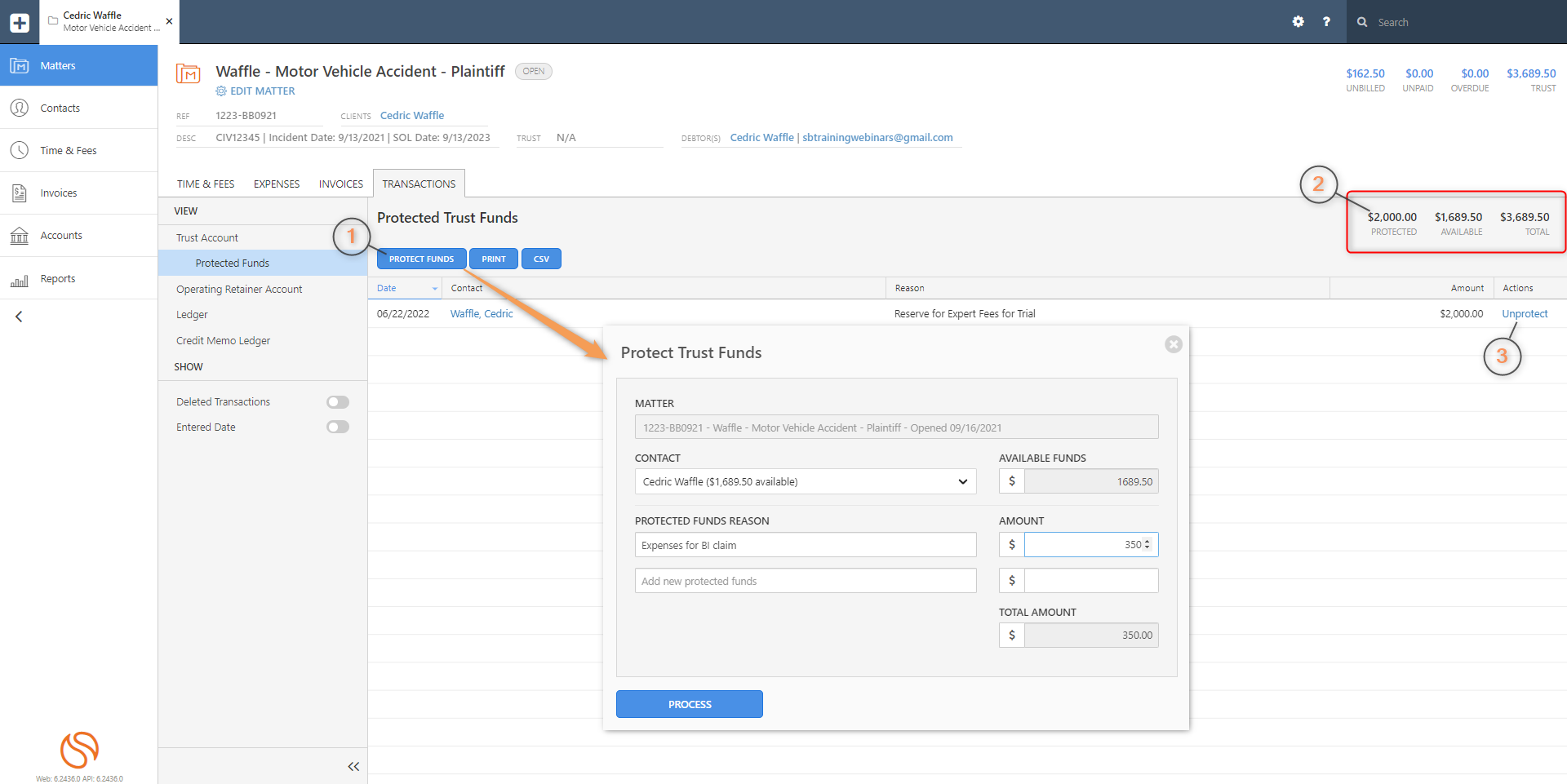

Once funds have been deposited into a client's trust account, you will have the option to protect them.

- The Protected Funds subaccount is the holding space where you can view and manage Protected Trust Funds on a matter. NOTE: This is not a separate trust account.

-

- Add funds to be protected. Follow the steps and provide the protection details. If you have funds earmarked for more than one specific purpose, you can enter multiple protections in this window.

- View a summary of protected and available funds in trust.

- Unprotect the funds at any time once they are ready to be dispersed.

-

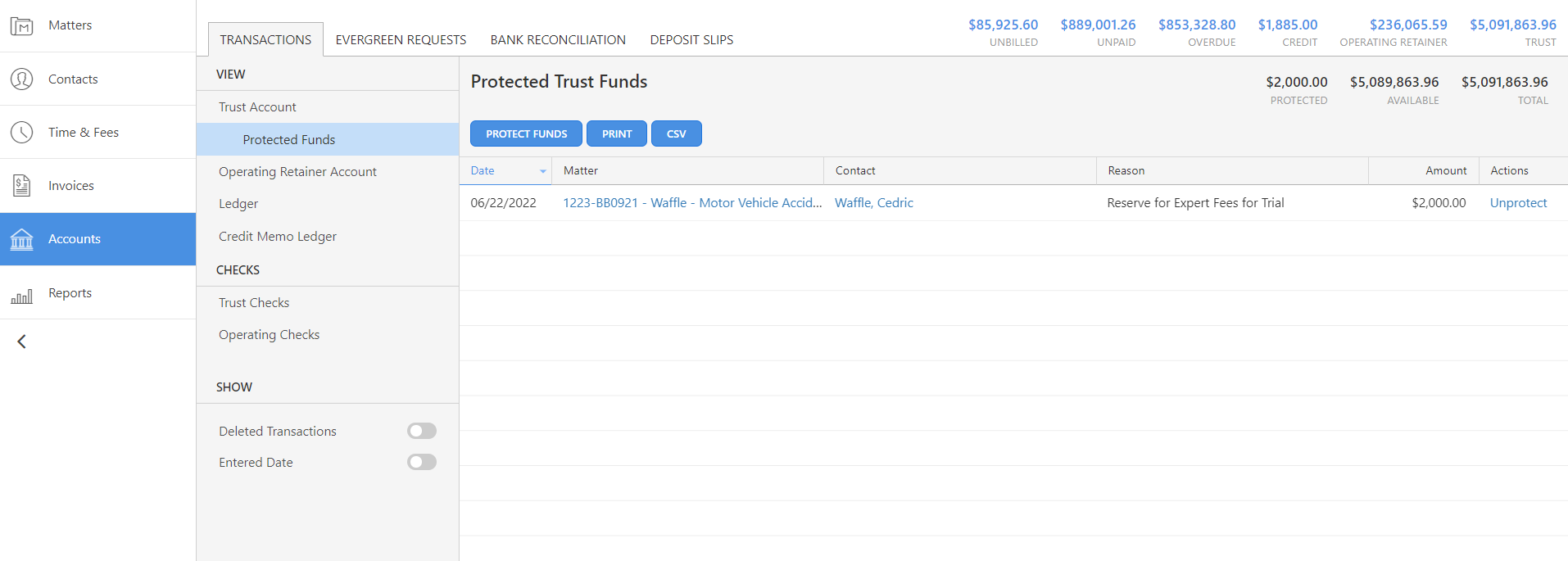

- If you would like to view this on a firm-wide basis, you can do so from the Accounts tab in Smokeball Bill.